Business Lawyer Arlington, VA

Your Dedicated Business Attorneys

Do you own a business? While many will only turn to a lawyer after a lawsuit has been filed, there are some things you can do to avoid court in the first place. In fact, it’s in your best interest to consult with our Arlington, VA business lawyer before things escalate and end up in the courtroom. Our firm is committed to providing elite legal services and strategies centered around you and your objectives.

As the old saying goes, an ounce of prevention is worth a pound of cure. Sometimes investing a little money up front to team up with our quality lawyer will save you a lot of money in the long run.

For example, perhaps you need someone to help you draft contracts for your business. If you are selling your services, you need a good contract that will protect you. What if you provide quality services and then your customer refuses to pay you? It’s better to speak with our attorney before this happens because a poorly drafted contract may not be enforceable. We will meet with you and get an understanding of the specific terms you want included in your business contracts, then put those terms into a binding and enforceable contract that will protect you in the future. Contact May Law, LLP today to schedule a consultation.

You may also need our business law attorney to help you in dealing with employee matters. Maybe you need non-compete, non-solicitation, or non-disclosure agreements for your employees? Without these kinds of restrictions, one of your employees could take your company’s ideas and share them with our competitors. Our firm can help you to draft strong employee agreements.

Our Arlington lawyer can also help you with employee disputes. An employee or former employee can accuse you of discrimination or failure to pay them. As soon as these kinds of allegations are made, do not ignore them. Consult with our attorney. We can help you negotiate with the employee to resolve things amicably before you are sued.

Finally, if your business is sued for any reason or needs to sue someone for any reason, you need strong legal representation in your corner. You also need to act quickly to address lawsuits (whether you are the person suing, or the person being sued) because there are strict timelines associated with business lawsuits. Our attorney will know the applicable timelines and protect your interests in the event of civil litigation.

How Our Business Lawyer Can Help You

If you own a business or are in the process of forming a business, having our dedicated business lawyers on your side is invaluable. From verifying compliance with regulations to reviewing business contracts, assisting with disputes, and more, our team is here to help you and your business with all your legal needs.

Compliance With Laws and Regulations

Running a business involves managing a complicated list of local, state, and federal regulations, and our business lawyers can help you stay compliant. Here’s how we can assist:

- Licensing and Permits: Many businesses require specific licenses and permits to operate legally. Our lawyer can guide you through the application process and make certain that all necessary documentation is in place.

- Employment Laws: Business lawyers help make sure that your business adheres to employment laws, including wage and hour laws, anti-discrimination regulations, and safety standards. This reduces the risk of frivolous lawsuits or costly fines.

- Tax Compliance: Tax laws are ever-evolving, and failing to comply can lead to heavy penalties. Our lawyer can help you understand tax codes, structure your business for tax efficiency, and complete timely tax filings.

- Industry-Specific Regulations: Certain industries, like healthcare, finance, or food and beverage, are subject to specific laws and regulations. Our legal team can help you understand and adhere to these specialized requirements, reducing the risk of non-compliance.

Draft and Review Contracts

Contracts are a fundamental aspect of any business relationship, and our Arlington business lawyer plays a critical role in verifying they are fair and enforceable under business laws. Here’s how we can help:

Business Agreements

Whether you’re entering into a partnership, signing a lease for office space, or agreeing to a supply contract, our lawyer can make sure that your interests are protected and that the terms are clear and legally binding.

Employee Contracts

Business lawyers can draft employment contracts that clarify job duties, compensation, and confidentiality agreements, helping to avoid future disputes with employees.

Customer and Vendor Contracts

Having legally sound contracts in place with customers and vendors can prevent disputes over deliverables, payment terms, and product quality. Our lawyer can help draft or review these contracts to confirm they protect your business.

Non-Disclosure and Non-Compete Agreements

If you’re dealing with proprietary information or hiring employees who may work with competitors, our lawyer can help you draft non-disclosure or non-compete agreements to protect your business interests.

Protect Your Business From Legal Risks

Every business faces legal risks, and our business attorneys help mitigate these risks and protect your company’s reputation and financial stability. Here’s how:

Intellectual Property Protection

Our lawyer can assist in securing intellectual property rights for your business, such as trademarks, patents, and copyrights, preventing others from using your creative or innovative work without permission.

Litigation Prevention

We can help identify potential legal issues before they escalate into lawsuits. We can mediate disputes, handle workers compensation issues, offer guidance on risk management, and help you avoid costly legal battles by resolving issues early on.

Business Structure

Choosing the proper legal structure for your business (LLC, corporation, sole proprietorship, etc.) is essential for minimizing personal liability and optimizing tax benefits. Our lawyer can help you decide the best structure based on your goals and protect you from personal liability.

Insurance Advice

Our lawyer can also advise you on the types of insurance you need to protect against potential risks, such as general liability, product liability, or errors and omissions insurance, ensuring you are adequately covered.

Resolve Disputes and Litigation

Disputes are inevitable in business, whether with employees, customers, or other companies, but our lawyer can help you overcome these challenging situations.

When it comes to resolving employee disputes, such as issues over wages, harassment, or wrongful termination, our attorney can assist in handling these matters before they escalate into lawsuits. If your business is sued or you need to take legal action against another party, our litigation lawyer can represent you in court, managing all aspects of the litigation process from filing lawsuits to negotiating settlements or going to trial.

Many legal disputes can also be resolved outside the courtroom through alternative dispute resolution (ADR) methods like mediation or arbitration, and we can facilitate these negotiations to help you reach a favorable outcome without prolonged litigation. Additionally, if your business is dealing with unpaid invoices or debts, our lawyer can help recover the money owed through legal channels, including sending demand letters, filing lawsuits, or seeking court orders for payment.

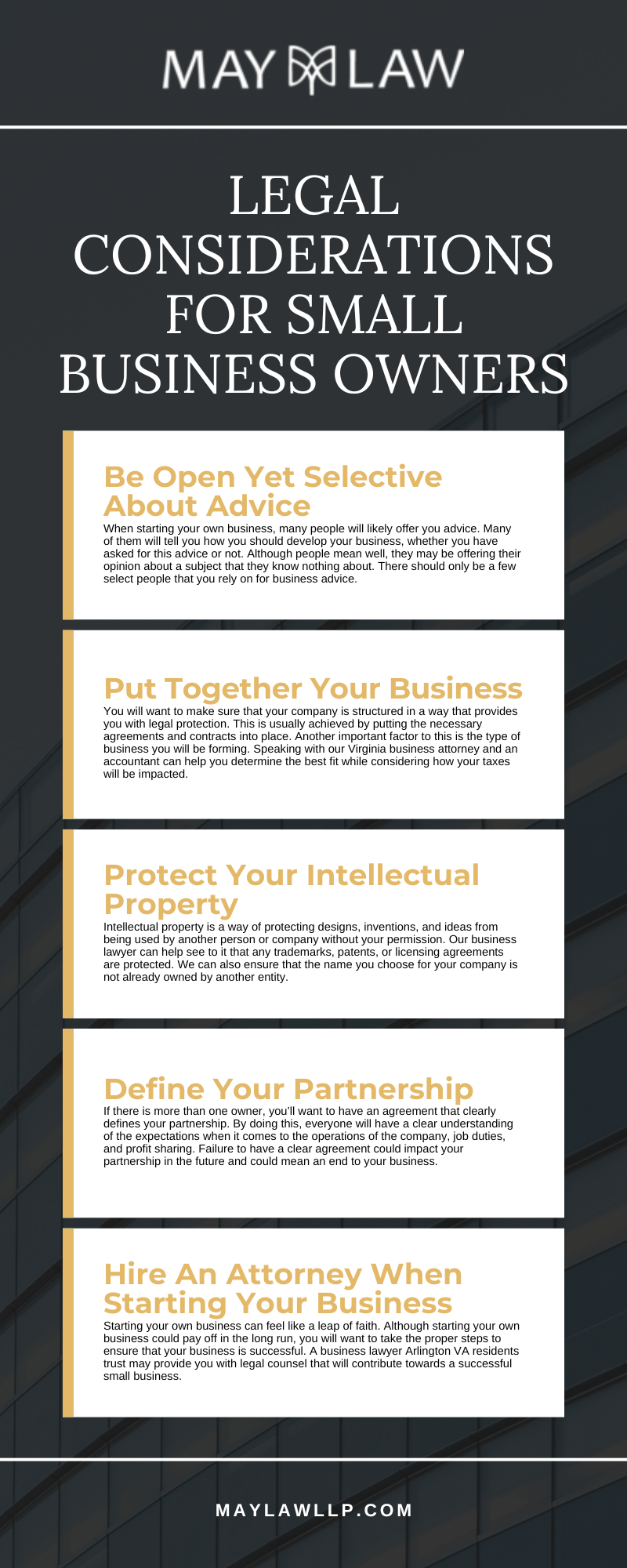

Legal Considerations For Small Business Owners

Developing a small business begins with the birth of an idea. It takes a lot of work for a prospective business owner to plan and build a business from the ground up. Making a dream into a reality takes commitment and a considerable amount of drive.

There are a number of factors to consider when starting a small business. Perhaps one of the most important aspects is confirming that your business is legally compliant with federal and state laws. As an entrepreneur, you will also want to make sure that you are legally protected from others trying to take advantage of you. Working with our Arlington business lawyer who is well-versed in business law may be very beneficial for your small business.

- Be Open Yet Selective About Advice

When starting your own business, many people will likely offer you advice. Many of them will tell you how you should develop your business, whether you have asked for this advice or not. Although people mean well, they may be offering their opinion about a subject that they know nothing about. There should only be a few select people that you rely on for business advice.

- Put Together Your Business

You will want to make sure that your small business is structured in a way that provides you with legal protection. This is usually achieved by putting the necessary agreements and contracts into place. Another important factor to this is the type of business you will be forming. Speaking with our Virginia business attorney and an accountant can help you determine the best fit while considering how your taxes will be impacted.

- Protect Your Intellectual Property

Intellectual property is a way of protecting designs, inventions, and ideas from being used by another person or company without your permission. Our business lawyers can help see to it that any trademarks, patents, or licensing agreements are protected. We can also check that the name you choose for your company is not already owned by another entity.

- Define Your Partnership

If there is more than one owner, you’ll want to have an agreement that clearly defines your partnership. By doing this, everyone will have a clear understanding of the expectations when it comes to the operations of the company, job duties, and profit sharing. Failure to have a clear agreement could impact your partnership in the future and could mean an end to your business.

- Hire An Attorney When Starting Your Business

Starting your own business can feel like a leap of faith. Although your efforts could pay off in the long run, you will want to take the proper steps to make sure that your business is successful. We can provide you with legal counsel that will contribute towards a successful small business.

Arlington Business Law Infographic

Arlington Business Law Statistics

Business contract disputes are a significant aspect of commercial litigation in the United States. According to national statistics, there are approximately 12 million contract disputes are filed each year.

These disputes often arise from issues such as non-performance, delayed deliveries, and quality concerns. To mitigate the risk of such disputes, businesses are advised to form clear and comprehensive contract terms and to engage in thorough vetting of business partners.

Don’t risk your business. Call our Arlington business lawyers for legal assistance.

Arlington Business Law FAQs

If you own a business, you may wonder why you need to work with our Arlington, VA business lawyer. A number of legal issues can arise in a business, and you want to protect your company. To learn more, call May Law LLP.

What Is a C Corporation?

A C corporation is a legal entity that is separate from its owners, allowing the corporation to make decisions, own property, and have liabilities and assets independent of its shareholders. The owners of a C corporation are referred to as stockholders or shareholders because they own shares of the company’s stock. The activities of the C corporation are legally separated from those of the shareholders, including revenue, sales, liabilities, assets, and expenses. A Virginia C corporation can be formed with the assistance of business lawyers in Virginia, such as our team at May Law LLP.

What Is an S Corporation?

An S corporation is a type of corporation where the owners, known as stockholders or shareholders, own shares of the company’s stock. Similar to other types of corporations, the activities of an S corporation are legally separated from those of its shareholders, including the revenue, sales, liabilities, assets, and expenses. This separation helps protect the shareholders from personal liability for the corporation’s debts or legal obligations.

How Do C and S Corporations Differ in Terms of Paying Taxes?

If you are considering what type of corporation to form, it’s important to gain an understanding of your choices and the potential tax obligations of each.

Our attorneys can provide more detailed information, particularly as it pertains to your specific circumstances, but the fundamental difference between the two is as follows:

- A C corporation is an entity that is separate from the corporation’s owners.

- In an S corporation, the corporation’s owners (shareholders) pay taxes on their shares of the company if they enjoy a return on them. They also record monetary losses and deductions associated with the shares when they file their taxes.

- C corporation and S corporation owners have equal protection if a lawsuit is filed against the corporation. This is because any activities of the corporation are separate from its owners and so the corporation’s liability cannot transfer to the shareholders.

- C corporation shareholders are taxed based on the amount of dividends that they receive from their shares. Individuals who are shareholders and also have paid positions within the company (such as an employee or executive) they are obligated to also pay taxes on their regular, personal earnings.

- C corporation shareholders do not receive dividends. The corporation is obligated to file taxes based on the year’s net profit or loss but the burden of paying taxes on the profits falls on the shoulders of the shareholders. In other words, they must pay taxes on their earnings when reporting their personal tax return.

Arlington Business Glossary

At May Law, LLP, we understand that business owners in Arlington, VA often encounter legal terms and concepts that may seem unfamiliar. As your trusted legal partner, we’re here to clarify these terms to help you protect your business and make informed decisions. Below, we’ve provided definitions and explanations of some common legal terms you may encounter when working with our Arlington business lawyers.

Non-Disclosure Agreements (NDA)

In business, protecting sensitive information is crucial. A Non-Disclosure Agreement (NDA) creates a legally binding agreement between parties to keep certain information confidential. This is especially important when sharing trade secrets, proprietary business strategies, or other sensitive data. Whether you’re onboarding a new employee or negotiating a partnership, having a well-drafted NDA can shield your business from potential breaches of trust.

Non-Compete Agreements

Maintaining your competitive edge often requires establishing boundaries with employees or partners. A Non-Compete Agreement restricts one party from engaging in business activities that directly compete with another, typically within a specific geographic area and for a certain time frame. For example, if a key employee leaves your company, a non-compete agreement can prevent them from immediately working with a competitor or starting a rival business using your trade secrets.

Intellectual Property (IP)

Your business’s identity, ideas, and innovations are valuable assets. Intellectual Property (IP) refers to creations such as inventions, designs, trademarks, and copyrighted materials. Protecting your IP is essential to safeguarding your brand and preventing unauthorized use by others. Whether it’s registering a trademark for your logo or securing a patent for a new product, our Arlington business lawyers at May Law, LLP can help you establish ownership of your intellectual property.

C Corporations

If you’re considering forming a corporation, a C Corporation offers a structure where the business operates as a separate legal entity from its owners. This setup provides limited liability protection, meaning shareholders are generally not personally responsible for the corporation’s debts or legal obligations. However, C Corporations face double taxation—once on corporate profits and again on dividends paid to shareholders. Additionally, shareholder disputes can arise over disagreements regarding operational procedures, acquisitions, the sale of assets, and other business matters. Despite this, they offer advantages like attracting investors and scaling your business. We can guide you through the process to determine if this entity suits your business goals.

Alternative Dispute Resolution (ADR)

When conflicts arise, resolving them quickly and cost-effectively is often a priority for business owners. Alternative Dispute Resolution (ADR) includes methods like mediation and arbitration that help settle disputes without going to court. For instance, a contract dispute with a vendor could be resolved through arbitration rather than enduring a lengthy litigation process. ADR is often faster and less adversarial, allowing businesses to preserve professional relationships.

Running a business involves many decisions that require sound legal guidance. At May Law, LLP, we’re proud to have provided dedicated legal representation to businesses throughout Arlington and Northern Virginia since 1995. Whether you need help drafting a contract, protecting intellectual property, or resolving disputes, our experienced team is here to assist. Contact us today to schedule a consultation and let us help you safeguard your business’s future.

May Law, LLP, Arlington Business Lawyer

3033 Wilson Blvd, Arlington, VA 22201

Contact Our Arlington Business Lawyer Today

Whether you are just starting a business or have owned your company for years, our Arlington business lawyer can be your best business advocate. Call May Law, LLP to make sure you are protected no matter what issues your business faces. Even a minor dispute can blow up into a legal battle that risks lawsuits, bankruptcy, and other financial penalties. From safeguarding your personal assets to crafting profitable contracts, our attorneys will be your legal partners in every business venture. Schedule a meeting today to get started.

Resources:

Client Review

"Amelia was so responsive to my concerns and needs. She did not waste any time providing me with the assistance I needed. Not only was she knowledgeable and able to provide me with advice, she was personable, friendly, and sensitive to my concerns. I highly recommend May Law, LLP to anyone in need of a lawyer!" Megan Girvin