Divorce Lawyer Fairfax, VA

Legal Assistance With Your Divorce

Divorce is an emotionally charged process that marks the legal dissolution of a marriage, and if you are going through the process of divorce, our Fairfax, VA divorce lawyer is here to help you. In such challenging times, the guidance of our knowledgeable and compassionate attorney is invaluable.

At May Law, LLP, we understand the emotional toll divorce can take on individuals and families. Our team of experienced divorce lawyers in Fairfax, VA, is committed to providing personalized and empathetic legal assistance. We guide our clients through each step of the divorce process to make sure they’re fully informed and supported.

Whether it’s negotiating amicable settlements or representing our clients in court, we’re dedicated to achieving the best possible outcomes. For those facing the challenges of divorce, we encourage you to reach out to us at May Law, LLP.

The Cost Of Filing For Divorce

Divorce, while an emotional and personal journey, also encompasses significant financial considerations. In Virginia, as in other states, the cost of filing for a divorce can vary widely based on several factors. At May Law, LLP, we believe it is crucial for clients to have a clear understanding of the potential costs involved in order to prepare effectively for the legal process ahead.

Initial Filing Fees & Court Costs

The journey of divorce legally begins with the filing of a petition in a Virginia court. The cost for this filing can vary depending on the county, but typically ranges from $80 to $100. This fee is mandatory and covers the administrative costs of processing the divorce paperwork. In some cases, additional fees may be required for serving documents to the other party or for using a court reporter during hearings.

Attorney Fees

One of the most significant expenses in a divorce is attorney fees. At May Law, LLP, we understand that each divorce case is unique, and thus, the cost of legal representation can vary. Factors influencing attorney fees include the complexity of the case, the length of time it takes to resolve, and the level of conflict between the parties. Hourly rates for lawyers can range widely, but it’s essential to remember that investing in experienced legal counsel can be invaluable in navigating the divorce process effectively and safeguarding your interests.

Costs Of Mediation & Alternative Dispute Resolution

Many couples in Virginia opt for mediation or other forms of alternative dispute resolution to settle their differences. This approach can be less adversarial and more cost-effective than traditional court proceedings. Mediation involves hiring a neutral third party to help negotiate an agreement on issues such as property division, child custody, and support. The cost of mediation depends on the number of sessions required and the mediator’s fees.

Witnesses & Additional Legal Expenses

In some divorce cases, especially those involving complex financial assets or child custody issues, it may be necessary to engage expert witnesses. These experts, such as financial analysts, child psychologists, or real estate appraisers, provide specialized knowledge to support your case. The cost of these experts will add to the overall expense of the divorce.

Potential For Spousal Or Child Support

In the state of Virginia, there may also be considerations for spousal support (alimony) or child support. The court determines these based on various factors, including income levels, the length of the marriage, and the needs of the children involved. While not direct costs of the divorce process itself, they are financial aspects that need to be considered.

Understanding The Divorce Timeline

The process of finalizing a divorce in Virginia, like in many states, varies greatly depending on numerous factors. At May Law, LLP, we understand that navigating the timeline of a divorce can be confusing and overwhelming. It’s essential for individuals going through this process to have a clear understanding of what to expect in terms of time commitment.

Key Factors Influencing The Divorce Timeline

- Type of Divorce: In Virginia, divorces are either classified as ‘contested’ or ‘uncontested.’

- Uncontested Divorces: These are typically quicker as both parties agree on all major issues like property division, child custody, and spousal support.

- Contested Divorces: These require more time due to disagreements that need resolution through mediation or court hearings.

- Mandatory Separation Period: Virginia law mandates a separation period before filing for divorce.

- With Children: Couples with minor children must live apart for one year.

- Without Children: Couples without minor children and who have a separation agreement can file after living apart for six months.

- Issues Of The Case: The complexity of issues like asset division, child custody, and spousal support can extend the timeline significantly.

The General Timeline For A Virginia Divorce

- Filing the Complaint: The divorce process officially begins when one spouse files a Complaint for Divorce with the appropriate Virginia court.

- Serving the Complaint: The other spouse must be legally served with the divorce papers, which can take a few weeks.

- Waiting Period: After serving the complaint, the mandatory waiting period (six months to one year) must be observed.

- Negotiation and Mediation: For contested divorces, this period can vary greatly depending on the willingness of both parties to negotiate and reach agreements.

- Trial and Final Decree: In contested cases, a trial may be necessary. The court will then issue a Final Decree of Divorce.

- Finalizing the Divorce: After all requirements are met, and the judge signs the decree, the divorce is finalized. This can take a few weeks to several months post-trial.

At May Law, LLP, we believe in providing our clients with a clear understanding of the divorce process in Virginia. We are committed to guiding you through each step, from the initial filing to the final decree, with professionalism and empathy. Our experienced team can help you navigate your specific case with confidence and care.

Understanding Prenuptial & Postnuptial Agreements

These legal documents are designed to protect individual interests, assets, and responsibilities within a marriage. Our experienced divorce lawyer provides comprehensive guidance to couples considering these agreements.

Planning Before Marriage

A prenuptial agreement, commonly known as a prenup, is a contract entered into by a couple before they get married. This document typically outlines how assets will be divided in the event of a divorce or death. It’s especially crucial for those entering a marriage with significant assets, children from previous relationships, or business ownerships.

Key Elements Of A Prenup

- Asset and Debt Division: Details how assets and debts will be divided.

- Alimony: Outlines if and how much spousal support will be provided.

- Protection from Debt: Protects each party from the other’s debts.

- Inheritance Rights: Clarifies inheritance rights for children from previous marriages.

Benefits Of A Prenup

- Financial Clarity: Provides a clear financial plan for the future.

- Protection of Assets: Safeguards individual assets and business interests.

- Minimizes Conflict: Reduces potential for disputes in case of divorce.

Securing Assets After Marriage

Unlike prenups, postnuptial agreements are made after a couple is already married. These documents are similar in content and purpose to prenuptial agreements but are designed to address changes in the couple’s financial situation or relationship dynamics that have occurred since the marriage.

When To Consider A Postnup

- Change in Financial Status: Significant changes in income, inheritance, or business interests.

- After a Reconciliation: Following a period of marital discord or separation.

- Changes in Career: One spouse stops working or changes careers.

Advantages Of Postnuptial Agreements

- Updated Financial Arrangements: Reflects the current financial situation of the couple.

- Reinforces Trust: Can strengthen the marriage by addressing financial concerns.

- Preemptive Conflict Resolution: Helps in avoiding disputes if the marriage ends.

Legal Considerations & Validity

For both prenuptial and postnuptial agreements to be legally binding in Virginia, certain criteria must be met:

- Voluntary Agreement: Both parties must enter into the agreement voluntarily, without coercion.

- Full Disclosure: Complete disclosure of assets and liabilities is required.

- Fairness: The agreement must be fair and reasonable to both parties.

- Legal Representation: It’s advisable for each party to have their own attorney.

At May Law, LLP, we understand the sensitivity and importance of prenuptial and postnuptial agreements. Our seasoned Fairfax divorce lawyer offers reliable and personalized legal counsel to see that your prenup or postnup agreement is comprehensive, fair, and legally sound. We work closely with our clients to understand their unique situations and tailor agreements that meet their specific needs and protect their interests.

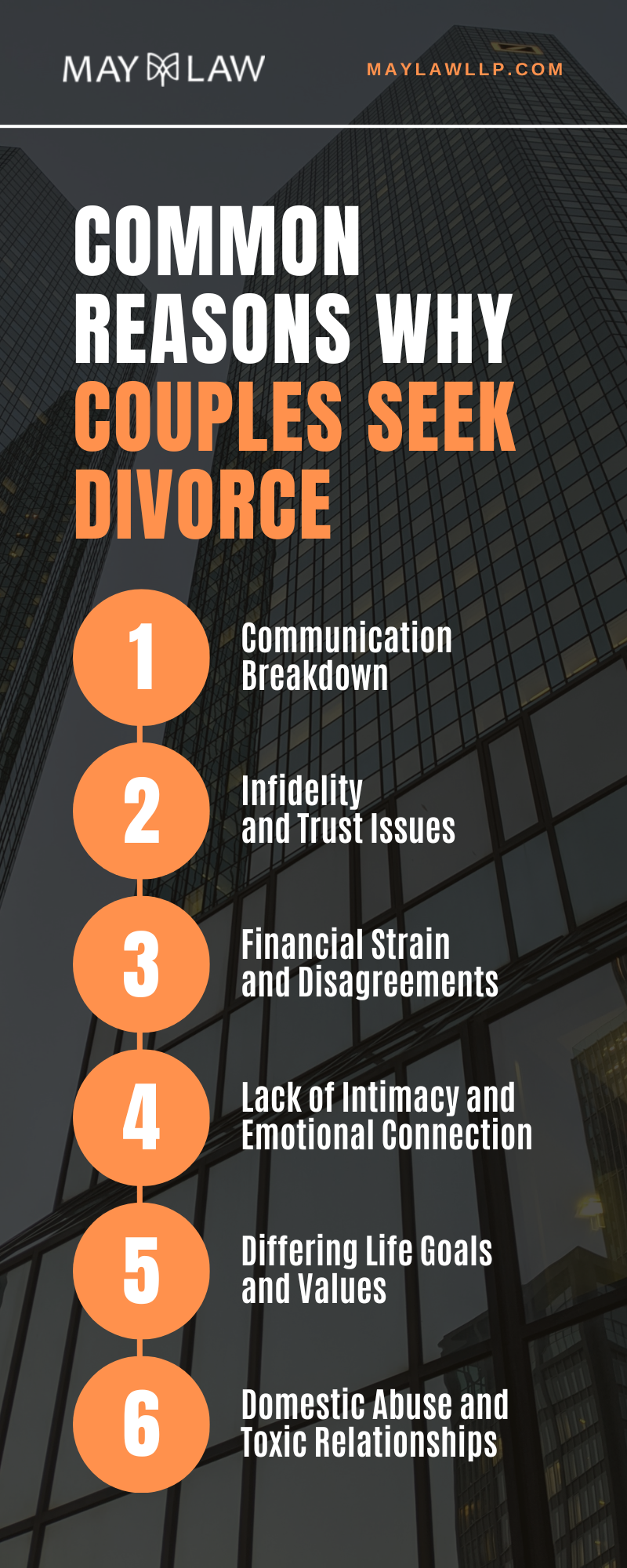

Common Reasons Why Couples Seek Divorce

Divorce, an often challenging and emotional journey, signifies the end of a marital union and the commencement of a new phase of life. Various factors contribute to the decision to pursue a divorce, and understanding these reasons can provide insights into the complexities of marital relationships. In our experience as a team at May Law, LLP, we’ve encountered a range of circumstances that lead couples to seek legal separation.

- Communication Breakdown

One of the most frequently cited reasons for divorce is the breakdown of communication. When couples are unable to effectively communicate, misunderstandings and resentments can build up over time. This often leads to a feeling of emotional disconnect, where spouses feel more like roommates than partners. In such situations, the lack of communication can make it challenging to resolve conflicts and address issues constructively, eventually pushing the couple towards the decision to divorce.

- Infidelity & Trust Issues

Trust is a cornerstone of any relationship, and once broken, it can be challenging to rebuild. Infidelity is a significant breach of trust and is often a deal-breaker in marriages. The emotional turmoil caused by an affair can lead to irreparable damage in the relationship. Even in cases where infidelity isn’t present, general trust issues, whether stemming from past experiences or current behaviors, can erode the foundation of a marriage.

- Financial Strain & Disagreements

Financial difficulties and disagreements over money management are common triggers for marital strife. Differences in spending habits, financial goals, or one partner bearing an unequal financial burden can create significant stress in a marriage. This stress, if not managed effectively, can lead to arguments and a breakdown in the relationship, often necessitating the intervention of a divorce attorney.

- Lack Of Intimacy & Emotional Connection

Physical and emotional intimacy is vital in a marital relationship. A decline in intimacy, whether emotional or physical, can leave partners feeling isolated and unloved. This might be due to various factors, including stress, health issues, or changes in life circumstances. When couples are unable to reconnect on an intimate level, it can lead them to question the viability of their marriage.

- Differing Life Goals & Values

Over time, individuals evolve, and their goals and values may change. When these changes occur in a manner not aligned between spouses, it can create a rift in the marriage. Whether it’s about career aspirations, family planning, or lifestyle choices, divergence in fundamental beliefs and goals can be challenging to reconcile.

- Domestic Abuse & Toxic Relationships

Unfortunately, domestic abuse, whether physical, emotional, or psychological, is a significant reason many seek divorce. In such situations, the safety and well-being of the abused partner and any children involved are the primary concerns. Escaping a toxic and harmful environment becomes essential.

Fairfax Divorce Infographic

Divorce Statistics

According to the American Psychological Association, approximately 40 to 50 percent of first marriages end in divorce. The divorce rate for second marriages is even higher, with approximately 60 to 67 percent of second marriages ending in divorce.

FAQs

How much does a divorce lawyer cost in Virginia?

The cost of hiring a divorce lawyer in Virginia can vary widely depending on the complexity of your case, the lawyer’s experience, and the specific services required. For a straightforward, uncontested divorce, attorney fees can start around $2,000 to $5,000.

However, in contested divorces involving disputes over assets, child custody, or spousal support, legal fees can escalate significantly, potentially reaching $10,000 or more. Additional costs like court fees, filing fees, and charges for expert witnesses or consultants may also apply. Many attorneys offer initial consultations to discuss the specifics of your case and provide a more accurate estimate of potential costs. It’s highly advisable to consult with a legal professional to understand the full financial implications of your divorce.

Do you have to be separated before divorce Virginia?

In Virginia, a period of separation is often required before filing for a no-fault divorce. For couples without minor children, the separation period is typically six months, provided that a separation agreement is also in place.

For those with minor children, the required separation period is generally one year. During this time, the couple must live apart and not cohabitate as a married couple in any manner. The separation period serves as a sort of “cooling-off” time, allowing both parties to make certain that divorce is indeed the path they wish to take, while also giving them time to sort out issues like property division, child custody, and spousal support. It’s crucial to consult with a legal professional to fully understand the requirements and implications of the separation period in your specific situation.

How is alimony calculated in Virginia?

In Virginia, there is no set formula or standard calculation for determining alimony, also known as spousal support. Instead, the court considers a variety of factors to assess the amount and duration of alimony payments. Some of these factors include the length of the marriage, the financial and non-financial contributions of both parties to the marriage, the earning capacity of each spouse, and the standard of living established during the marriage.

The court may also take into account the age and physical and mental conditions of both parties. Spousal support can be temporary or permanent and may be subject to modification based on changes in circumstances. Given the complexities and variables involved, it’s highly advisable to consult with a skilled attorney to understand how alimony might be calculated in your specific situation.

Is spousal support mandatory in Virginia?

Spousal support, commonly known as alimony, is not mandatory in Virginia. Whether or not spousal support is awarded depends on a variety of factors, including the needs and financial circumstances of each spouse, the duration of the marriage, and the contributions of each spouse to the family and household. The court will also consider other factors such as age, physical and mental condition, and standard of living during the marriage.

Even when spousal support is deemed appropriate, the amount and duration are subject to the court’s discretion. It’s important to consult with our knowledgeable Fairfax divorce lawyer to understand your rights and the specific factors that the court may consider in your case.

Do I need a divorce lawyer in Virginia?

Divorce is a life-changing event that can be emotionally draining, financially taxing, and legally complex. While Virginia law allows individuals to file for divorce without the aid of an attorney, navigating the nuances of divorce laws, division of assets, child custody, and spousal support can be overwhelming if you attempt to go it alone. At May Law, LLP, we understand that every divorce situation is unique, requiring personalized attention and compassionate legal guidance

May Law LLP

Contact Our Divorce Lawyer Today

At May Law, LLP, we understand that a divorce is an unpleasant process, but it doesn’t have to be. We can help you with all aspects of your divorce and protect your rights and interests throughout the entire process. If you have decided to end your marriage and anticipate issues over how your family business or finances in general will be affected by a divorce, then contact us today to set up a consultation with our reputable Fairfax divorce lawyer.

A divorce tends to overwhelm people. Even if they anticipated that their marriage was going to break down, when the divorce process actually starts, it becomes chaotic. Fortunately, you can reach out to a divorce lawyer to help you overcome any obstacles and start your next chapter with confidence and peace of mind.

Client Review

“Michael May was extremely responsive, professional and conscience of my time and his when working with me. I would recommend him to anyone who is need of a great lawyer.” Jason Dryer